Микроплатежи

We have come to the end of this list, and I hope that it has been helpful to you. Now go create your free email accounts without the fear of some random marketer calling you for email upgrades https://pechi-troyka.ru/content/pages/chto-takoie-koshieliek-ts-upis-v-bietsiti-obiasniaiem-na-pal-tsakh_1.html. If you have more free services to share, please feel free to comment below.

I used to be able to make mail.com accounts, and now I can’t get into any, or make new ones without phone numbers. I think something changed. It’s disappointing they did that… It was my backup for places that act weird about personal domains.

Even though it won’t cost you a penny to make an email account with mail.com, we don’t skimp on the mail features . We are proud to offer you a secure, reliable email experience with a range of great tools and features – entirely for free.

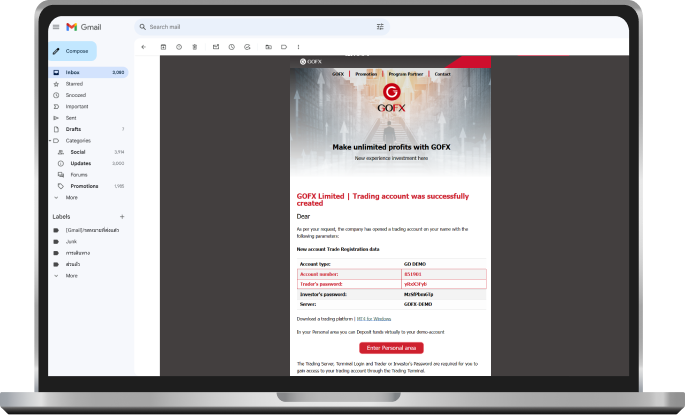

Demo account for beginners

But, no matter which company from my list you decide to go with, the demo account is one of the most important tools for a trader, because with this account you can try many things about real market situations for free and without risk.

But, no matter which company from my list you decide to go with, the demo account is one of the most important tools for a trader, because with this account you can try many things about real market situations for free and without risk.

As I mentioned earlier, Vantage Markets excels in offering exceptional trading conditions. The spreads start at 0.0001 pips and the commissions per lot are some of the lowest I have ever seen. You can expect to pay only 5 Euros or $6 per lot for example. To make things even better, there are also no hidden fees for currency exchanges or withdrawal fees on Vantage markets. They are plain and simple one of the best brokers in terms of costs and fees.

Their offer of leverage up to 1:500 in combination with very low fees and commissions is what makes the company so successful in my opinion. They also benefit, because they offer a way around the strict European ESMA leverage limitations. Also, you get to choose between spread-based and commission-based account types, which gives you way more flexibility with your trading strategy. If you are unsure, which account type is best for you, I found their customer support to be very knowledgeable and helpful.

What truly distinguishes the platform is a comprehensive suite of analytical tools, including AI-driven insights and an intuitive mobile app. There are very few other competitors that can compete with capital.com in that field. I found that Capital.com quite often sets standards for the entire industry, and other companies often copy the same new features a few months later. Their constant efforts to improve the trading experience, make their platform one of the most beginner-friendly and intuitive ones. Should you ever run into any issues the 24/7 customer support is always ready to help and there are great educational resources available for free.

One true advantage of a Vantage Markets demo account starts when you sign up. During the process, you have the option to customize the settings and choose the leverage level, account base currency, account type, and trading platform. There are no differences or limitations whatsoever compared to a live account, which is a huge plus in my opinion. The sign-up is also very quick and you even have the option to connect with a Google account.

Commission-free profit withdrawal

Charles Schwab has earned its strong reputation: The broker offers high-quality customer service, four free trading platforms, a wide selection of no-transaction-fee mutual funds and $0 commissions for stocks, ETFs and options.

Webull will appeal to the mobile-first generation of casual investors with its slick interface for desktop and mobile apps. The brokerage also delivers an impressive array of tools for active traders and a wide investment selection, including stocks (plus fractional shares), options, ETFs, crypto, commodities and futures. However, it lacks access to mutual funds.

With any trading platform, there are no guarantees you’ll earn a certain rate of return or current investment options will always be available. To determine the best approach for your specific investment goals, speaking with a reputable fiduciary investment advisor is recommended.

Fees may vary depending on the investment vehicle selected. Self-Directed Trading has zero commission fees for stock, ETF, options trades; $0.50 per options contract. Robo Portfolios have zero management fees

Training in the basics of trading

Trading, at its core, is the act of buying and selling financial assets, such as stocks, currencies, or commodities, in the hope of making a profit. Day trading, specifically, is a type of trading where positions are opened and closed within the same trading day. This means that the day trader does not hold any positions overnight, and aims to capitalize on the market’s short-term fluctuations.

Your first trade can seem daunting, but with the right approach and guidance, you can confidently execute your first trade. This beginner’s guide will walk you through the essential steps to ensure a smooth and informed entry into the trading world, from choosing a reliable broker to learning from your experiences. Follow these steps to kick-start your trading career.

RJ Hixson, an MBA graduate from the University of North Carolina, has a long history of trading experience. Since 2009, he has been an instructor at the Van Tharp Institute (VTI), where he has educated thousands of students on successful trading strategies. Hixson completed the Super Trader program and graduated in 2012, becoming an integral part of VTI due to his deep understanding of Dr. Van Tharp’s methodologies. As Vice President of Research and Development, he developed training products and shaped the curriculum for VTI programs, co-teaching workshops with Dr. Tharp and leading many others. He also contributed to the Van Tharp newsletter and worked closely with Super Trader Program students. Currently, he is the Co-Founder of TenHundred Marketing, and his dedication to trading education has made him a respected mentor in the community. Learn more about RJ Hixson.

Step 1: Choose a reliable broker. Select a reputable brokerage firm that offers the necessary trading tools, competitive fees, and access to your desired financial markets. Look for a broker that caters to beginners and provides educational resources and customer support.

Skills you’ll gain: Financial Statements, Financial Statement Analysis, Financial Trading, Balance Sheet, Securities Trading, Financial Analysis, Market Liquidity, Financial Market, Market Data, Market Dynamics, Market Analysis, Cash Flows, Equities, Order Management, Portfolio Management, Risk Analysis